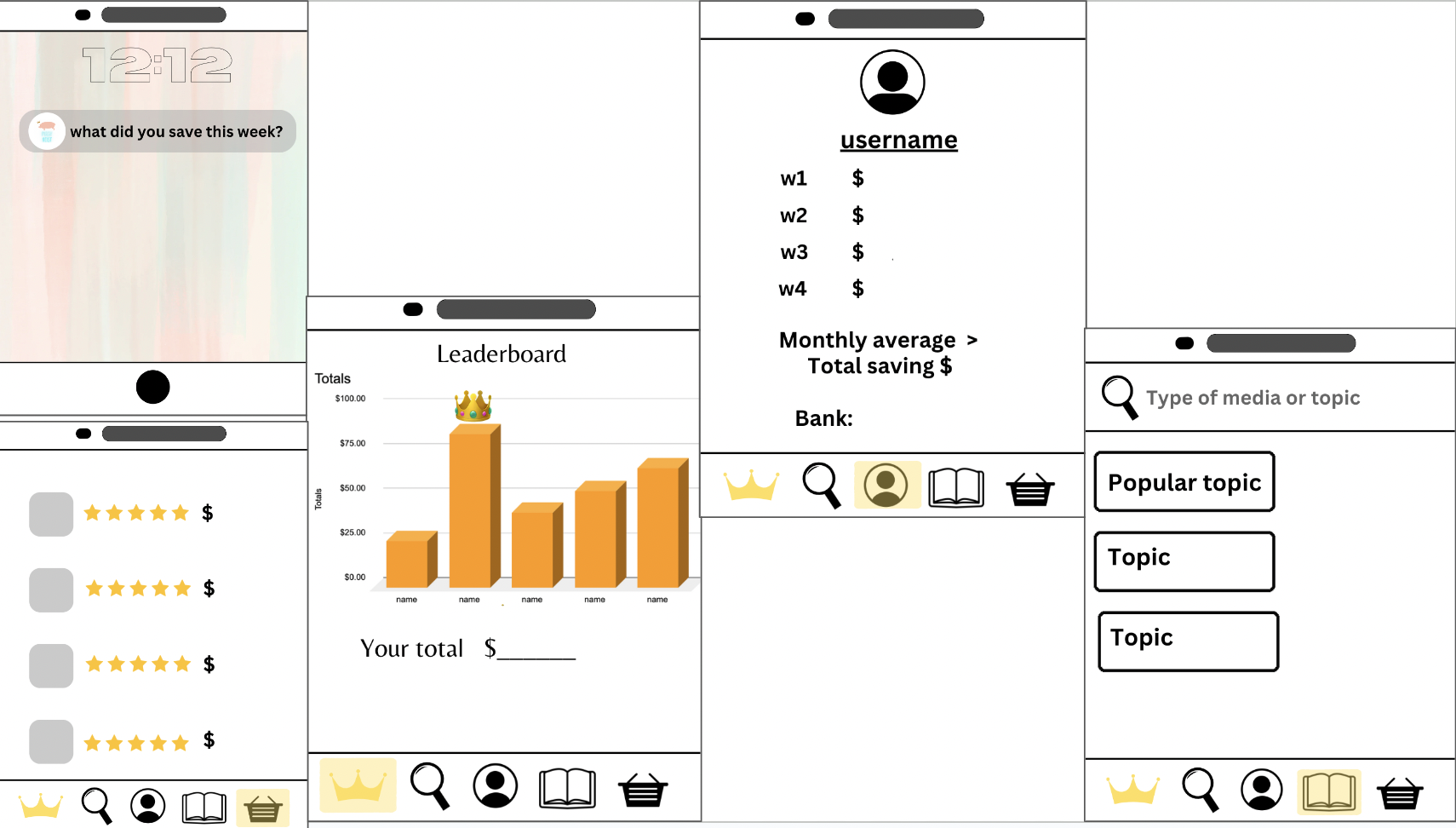

Piggy Hei$t | Making saving fun with friendly competition!

Project Team:

Abbey , Izzy , & Teammates

Status:

Crowdfunding

Social Purpose

Partnerships To Achieve The Goals

Connect:

What is the problem you found?

How might we make saving a more fun and interactive process, with a competitive edge amongst family and friends?

Customer / Problem

Our customer is mostly Gen Z (Aged 11 - 26)

The problem we have found is that people in our target audience are woke, broke and complicated—and spending money.

The problem needs to be solved because we want to help young adults healthily deal with their finances and be resourceful with their money.

Young generations do not know or understand how to save their money for the future, and may be coerced into buying things they don't need.

Saving is an important habit to get into for several reasons — it helps you cover future expenses, manage financial stress, plan for vacations and more.

_______

There is an increase, especially in the younger generations of over spending or buying things that they don’t need. 49%, of millennials (ages 18 to 35) say social media influenced them to spend money on experiences. Gen Z consumers are more likely to pay a premium for items that are unique and tailored to their interests, according to researchers

GENERATION Z SPENDS AN OUTSIZED PORTION OF THEIR INCOME ON EATING OUT, MOBILE DEVICES, TRANSPORTATION AND HOUSING!

What Is Your Solution?

Our solution is to create an engaging management app which is shared with friends and families. Piggy Heist is a competitive and interactive game that gets families and friends to compete against each other to see who can save the most in a month, without spending money on unnecessary objects like clothing and gadgets. It is an opportunity for young people to learn money skills and self control, while having fun and friendly competition with other people.

Gen Z is facing significant challenges related to student loans and other forms of debt. Effective financial management can help them understand how to manage their debt, make timely payments, and avoid falling into financial traps.

The app engages customers aged 11-26 to compete with friends and family to reach their money saving goals, and also gives educational and informational videos about savings and banking tips!

Comments